October 26th, 2021

How the government’s planned tax rises could impact your business owner clients

As you may remember, last month the government announced their plans to address the UK’s social care crisis to reduce the financial burden on the elderly. As well as introducing a cap on costs, the prime minister also announced that there would be tax rises to pay for the restructuring.

Mike Cherry, the head of the Federation of Small Businesses (FSB), was quoted in the Guardian as saying that the changes could severely impact business owners as they try to recover from “the most difficult 18 months of their professional lives”.

From 2022, both National Insurance contributions and Dividend Tax are set to rise, and this could impact your business owner clients. Read on to find out more about how it could affect them.

In 2022, the government will raise National Insurance contributions by 1.25p in the pound

In September, prime minister Boris Johnson announced plans to increase National Insurance contributions (NICs) and Dividend Tax from April 2022. These measures are hoped to raise £12 billion, which will be used to tackle the UK’s later-life care crisis.

Part of the money raised will also be put aside to help the NHS recover from the coronavirus pandemic. According to the Guardian, the healthcare system will receive £5.3 billion of the £36 billion these changes are set to raise over the next three years.

As of April 2022, both employers and employees will have to pay higher levels of National Insurance. Their contributions will increase by 1.25 percentage points and then, from April 2023, this extra amount will be collected as part of a new Health and Social Care Levy.

What is particularly noteworthy about this change is that, for the first time, this extra tax will also have to be paid by workers above the State Pension Age.

The change could cost small business owners £5.7 billion

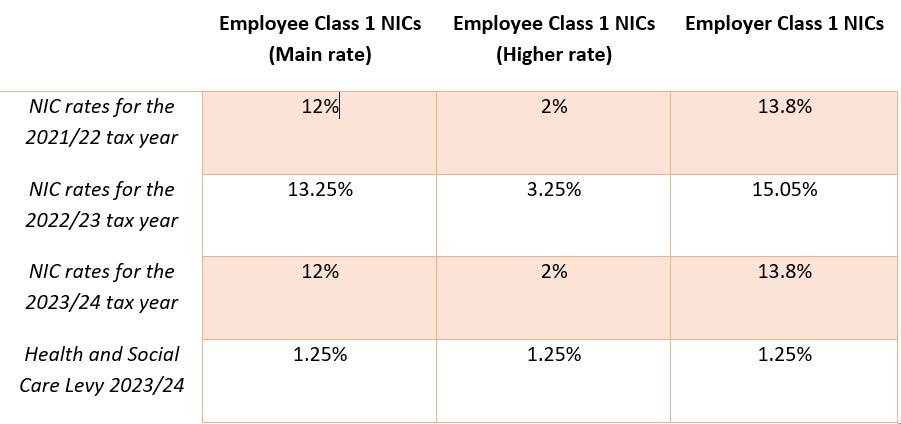

For small business owners, the change to National Insurance could eat into their profits. As you can see from the table below, both employers and employees currently pay Class 1 contributions, which is based on how much an employee earns.

This rate is 13.8% for employers and 12% for employees, up to a limit of £50,000 each year. Anything over this threshold is instead taxed at 2%.

Source: Money Saving Expert

From 2022, your business owner clients will have to pay higher NICs for their staff, meaning that they may have significantly reduced profits. Figures from FSB show that this change could cost small business owners around £5.7 billion.

According to government figures, around 640,000 small businesses will receive protection from the planned tax increase, thanks to the Employment Allowance. However, this figure only represents around 10.5% of the whole community, meaning that a significant number of people will be affected.

The NICs rise can affect the amount that sole traders can pay themselves

If you have clients who are sole traders, the change to NICs may affect them more than most. This is because they typically pay taxes through self-assessment, meaning that their rate is based on their income after business expenses.

What this means in practice is that the change directly impacts the salary that they will be able to pay themselves.

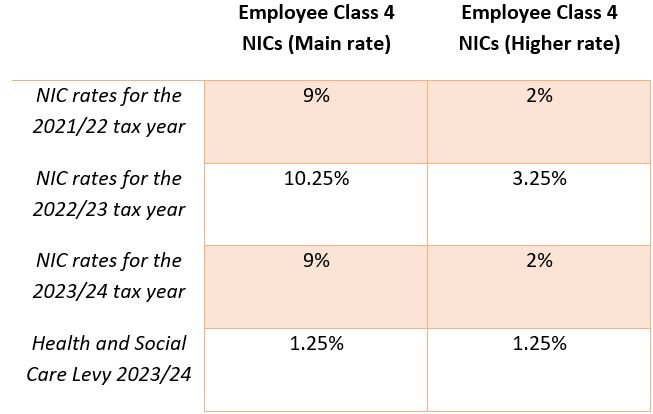

If your clients have an annual profit of more than £9,568 in the 2021/22 tax year, they will have to pay Class 4 NICs. They will also have to pay a higher rate on any earnings above £50,270.

Here is a breakdown of the rates that your sole trader clients will have to pay:

Source: Money Saving Expert

However, please bear in mind that some freelancers may pay the lower Class 2 level of NICs, particularly if they’re just starting out and haven’t had time to grow their business yet. Since the tax rise does not apply to this level of contributions, clients in this category may be unaffected.

Directors may be affected by the Dividend Tax increase

As you may know, many directors of businesses choose to take a portion of their salary through dividends. While this can be a good idea, they may face a tax increase as dividend tax is set to rise by 1.25 percentage points from April 2022.

If your clients receive more than £2,000 a year from company dividends, they may face a slightly higher tax bill, regardless of what income band they are in.

For example, let’s say that your client is a basic-rate taxpayer who receives £3,000 in dividends each year. With the Dividend Allowance standing at £2,000, this means they have to pay tax on the £1,000 above this limit. The tax increase means that their bill will rise from £75 to £87.50.

Alternatively, if they pay the higher-rate band of tax and take £10,000 in dividend payments, then they would pay 33.75% on the £8,000 of dividends over the threshold. This would result in a bill of £2,700, which is £100 more than what they would pay with the current level of Dividend Tax.

Get in touch

If you have clients who will be affected by the tax increase and who could benefit from financial planning to overcome it, we can help. Email enquiries@prosserknowles.co.uk or request a call back from one of our advisers.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production