May 18th, 2023

1 in 5 people are cashing in investments to help family. Here are 3 things you should know before you do

While people of all ages may be struggling financially as costs rise, young adults may be bearing the brunt of the cost of living crisis.

Starling Bank research, published by Fintech Global, found that 76% of young adults are putting their lives “on hold” during the cost of living crisis. Of the 2,000 UK adults surveyed, 17% of under-35s said they’re deferring buying a home, 26% are postponing holidays, and 12% are even putting off starting a family.

Your own adult children or grandchildren might share some of these concerns, and could be postponing important milestones as a result.

In response, you may be planning to help them financially – and liquidating shares might seem like a simple way to do so. Continuum research, published by FTAdviser, reports 1 in 5 people are cashing in investments to help family during the cost of living crisis.

While this could be a viable option for your family, there is plenty to consider before you liquidate assets to help others. Here are three important things you should know.

1. Gifting large sums to family could lead to an increased Inheritance Tax bill

If you’re planning to sell assets in order to transfer their value directly to family members, it’s important to know the tax implications of doing so.

Although it may help in the short term, gifting large lump sums to family may not be a tax-efficient solution in the long run. Indeed, while reducing the value of your estate over time can be useful to mitigate Inheritance Tax (IHT) when you die, large transfers while you’re living can still count towards an IHT bill in certain circumstances.

Here are some key gifting rules you should know about.

You can normally give up to £3,000 a year tax-efficiently

In 2023/24, you can give up to £3,000 a year tax-efficiently, split however many ways you like. This is known as your “annual exemption”.

For example, you could give the full £3,000 to one person, or £1,000 to three different people, between 6 April 2023 and 6 April 2024.

Notably, married couples can combine their annual exemption, meaning you could tax-efficiently gift up to £6,000 a year together. You can also carry forward any unused annual exemption from the previous year, giving you an up to £12,000 exemption in some cases.

In certain circumstances, though, giving more than your annual exemption could mean the excess is subject to IHT down the line.

Assets that surpass the nil-rate bands are usually subject to IHT

As you may be aware, part of your estate may be subject to a 40% IHT bill when you pass away.

The nil-rate band and residence nil-rate band mark how much you can pass down to your beneficiaries without paying IHT. As of 2023/24, they stand at:

- £175,000 for main residences passed to spouses, children or grandchildren

- £325,000 for most other assets (such as shares).

For example, if you passed down £400,000 in non-property assets, £75,000 of this is likely to fall into the IHT bracket.

Gifts in excess of your annual exemption could be subject to IHT

Crucially, any amount you give that exceeds £3,000 in one year could be subject to a tapered form of IHT, known as “taper relief”, if you pass away within seven years of transferring the funds.

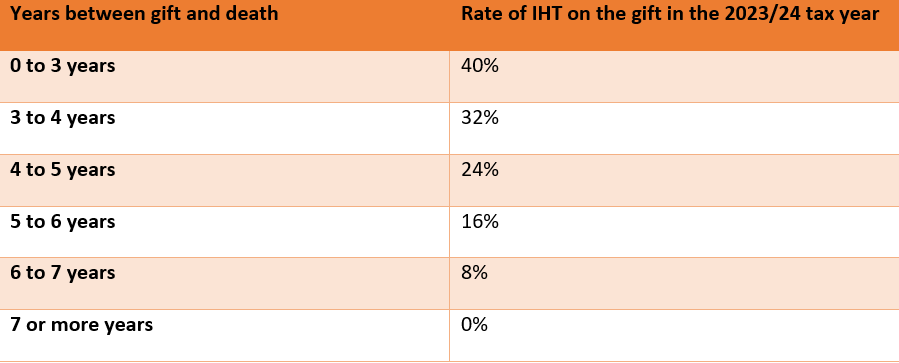

The below table shows the percentage of IHT your beneficiaries might pay on cash gifts in these circumstances.

Source: HMRC

Ultimately, if you plan to liquidate assets and provide family with a large injection of capital, it could be beneficial to check in with a financial planner and work out the potential tax liability of doing so.

We can help you weigh up the tax implications of this transfer against the benefits of the support you provide.

2. Small gifts can be both helpful and tax-efficient

As you read earlier, giving away large sums all at once can potentially increase your loved ones’ IHT bill down the line.

Fortunately, spreading your financial gifts over a longer period of time can still enable you to provide meaningful support without breaching your tax-efficient annual exemption of £3,000.

Similarly, you can give up to £250 a person as often as you like, provided you haven’t used another allowance on the same person – and these smaller top-ups could make a big difference, especially during the cost of living crisis.

Consulting your financial planner can be hugely constructive here. With enough forward planning, we can help you provide gradual support to loved ones during the cost of living crisis, while minimising the impact on your family’s tax bills where possible.

3. Your own long-term financial viability should be considered before you cash in shares

Before you cash in shares to help family members, thinking about how your own wealth could be affected long-term is essential.

Indeed, if your portfolio has dipped in value overall since the start of the Covid-19 pandemic, as many have, cashing in on investments could mean you crystallise those losses.

Alternatively, staying invested gives funds a chance to recover. While there is no guarantee of positive returns, the other alternative – crystallising the loss by selling that investment – leaves your wealth no opportunity to regain value.

On the other hand, if your portfolio has experienced an upswing in recent months, you could benefit from those profits if you sell assets to help family.

The immediate benefits or downsides of selling investments during the cost of living crisis could entirely depend on the current performance of your portfolio. A financial planner can help you assess your portfolio and advise on your next steps.

Importantly, though, even if you see profits when you sell up in the short term, liquidating assets will reduce the value of your portfolio overall. Doing so means your portfolio is likely to see less compound growth over the years.

What’s more, you are likely to pay Capital Gains Tax (CGT) on profits you earn from the sale of assets – so it is vastly important to factor CGT into the equation when deciding the best route forward.

Ultimately, if you are approaching retirement, or another life milestone that may require additional financial support, it’s important to stop and think about how selling investments to help family could affect your long-term goals.

If you’re torn between selling assets to help your loved ones and staying invested for your own long-term financial stability, we can help.

A financial planner will assess your portfolio and provide guidance based on years of market experience, so you can decide confidently on what to do next.

Get in touch

Are you considering selling investments to help family in the near future? Speak to us first. Email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Production

Production