August 10th, 2022

2 unmissable things to know about the housing market in 2022

Since the beginning of 2022, the cost of living crisis has created widespread concern up and down the UK.

The combination of the pandemic and the Ukraine war has contributed to a surge in the price of goods and services. This rapid increase is reflected by a 40-year high in inflation, with the Office for National Statistics (ONS) reporting an inflation rate of 10.1% in the year to July 2022.

As a result, the Bank of England (BoE) have raised the base rate six times since December 2021, from its historic low of 0.1%. As of August 2022, the base rate stands at a 14-year high of 1.75%.

You might be wondering: where does the housing market stand in all this? If you are applying for a mortgage this year, or are thinking of selling your home, it is crucial to understand how the market is behaving, and what might be coming around the corner in the months ahead.

So, here are two unmissable things to know about the property market in 2022.

1. House prices have been continually rising, but dropped incrementally in July 2022

At the end of 2021, experts predicted that, after a “boom” in the property market since the start of the pandemic, prices would level off in 2022. In December, the Guardian reported that Britain’s house prices would “slow down dramatically” this year.

However, defying all expectations, UK house prices continued to soar in 2022. According to the Halifax House Price Index, the average UK home cost £276,645 at the start of the year. By July, the average price had increased by just over £16,500.

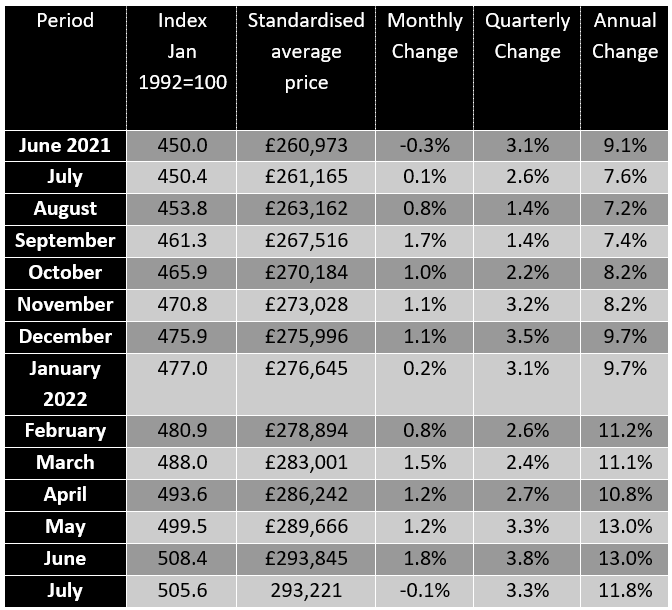

The below table illustrates how UK house prices have performed since June 2021.

Source: Halifax

In July 2022, the index shows house prices have decreased by 0.1%. While this may seem like a tiny drop, it may be a sign that the housing market could be changing direction in the months ahead.

Nevertheless, you might still be wondering: now that the cost of living crisis is tightening budgets, how and why are house prices still so high?

Halifax managing director, Russell Galley, claims in the July 2022 index report that “While we shouldn’t read too much into any single month, especially as the fall is only fractional, a slowdown in annual house price growth has been expected for some time.

“That said, some of the drivers of the buoyant market we’ve seen over recent years – such as extra funds saved during the pandemic, fundamental changes in how people use their homes, and investment demand, still remain evident.”

Nevertheless, Galley confirms that eventually the housing market may be caught by the UK’s drop in disposable income – and, as a result, price rises are predicted to slow further.

He states, “A slowing of annual house price inflation still seems the most likely scenario.”

So, if you are considering buying a home in the coming months, you may be pleasantly surprised to learn that while it is never certain what the market may do, experts predict that price growth will continue to ease.

This potential slowdown might come at the perfect time for you to find your dream home at a price you can afford. If you are looking to buy a home in the midst of a tricky economic period, contact your financial planner for professional guidance.

2. Borrowers may be subject to fewer affordability checks from now on

If you are considering applying for a mortgage this year, you could be concerned about affordability. As you have read, the average house price in the UK stood at almost £300,000 in July 2022 – meaning in order to afford the home you want, you may need to borrow more than you had expected.

The good news is that, in a move proposed in February 2022 and implemented in June, the Financial Policy Committee (FPC) has relaxed one element of affordability criteria for lenders. From now on, lenders are no longer required to check if borrowers can afford higher interest rates than the existing rate at the time the loan is taken out.

The FPC implemented this affordability rule in 2014, in an effort to lower mortgage debt risk in the wake of the 2008 financial crash.

So, if you’re looking to apply for a mortgage this year, this change could help you to obtain the mortgage you need. Our experts can help you establish your borrowing potential.

If you are selling your home this year, more lenient affordability criteria could also work to your advantage. You may find more homebuyers are able to make offers on your home, if they are able to borrow a higher amount than they might have in previous years.

Get in touch

As the housing market responds to a volatile economy, it is important to understand all your options. For buying, selling and letting advice you can trust, email enquiries@prosserknowles.co.uk or click here to request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Production

Production