July 21st, 2023

3 surprising Inheritance Tax and gifting myths you could believe, busted

As you get older, you might be beginning to consider how your wealth circumstances look when you pass away. There’s plenty to consider in this area, especially when it comes to Inheritance Tax (IHT).

Indeed, if your affairs are not in order before your death, it could mean that your loved ones are faced with an unnecessarily high IHT bill. This could cause confusion about how much money they’ll receive.

Fortunately, there are certain strategies you can employ when preparing your estate for a tax-efficient transfer. But there are also many prevalent myths around IHT, gifting money before you die, and other crucial financial matters – and falling for them could put your wealth at risk.

Making your estate tax-efficient may be especially important in the coming years. A report from Money Marketing reveals that Brits paid more than £7 billion in IHT in 2022/23, up from £5.2 billion five years previously.

So, here are three surprising IHT and gifting myths that many believe, busted – plus how a financial planner can offer invaluable insights when you’re thinking about your estate plan.

1. “40% of my estate will go straight to HMRC when I die”

If you’ve read about IHT before, you may know this one simple fact: IHT is usually charged at 40%.

However, there is a prevalent myth that all your wealth will be subject to IHT when you pass away. This is not the case. In fact, according to HMRC data published by Money Helper, only 1 in 20 UK households pay IHT – a far smaller number than you might imagine.

This is because there are “nil-rate bands”, which act as allowances, meaning that you can pass some wealth tax-free to the next generation.

As of the 2023/24 tax year, the nil-rate bands are as follows:

- £325,000 for all taxable assets.

- An additional £175,000 “residence nil-rate band” for property passed to direct descendants.

So, you could pass a total of £500,000 in assets (including property) down to your loved ones when you die. If you strategically combine your personal nil-rate bands with those of your spouse, you could technically double this figure to £1 million – although this may require significant forward planning with the help of a professional.

Ultimately, it’s important to remember that you’ll only pay IHT if the value of your estate surpasses the nil-rate bands. Any wealth that sits below them can usually be passed down tax-free.

2. “Giving my money away before I die will stop my loved ones from paying IHT”

Now you’re aware that your beneficiaries will only pay IHT if they inherit more than the amount set by the nil-rate bands, you might be thinking: “can’t I just give the rest of my money to my family before I die?”

Legally speaking, yes, you can. You may give large financial gifts to your family members at any point.

However, if your aim is to reduce IHT overall, it may be wise to exercise caution when handing money over to loved ones. Sadly, the myth that giving your money away now will avoid IHT altogether could actually increase your IHT bill in certain circumstances.

Here are a few basic money gifting rules you should know about in the 2023/24 tax year.

You have an “annual exemption” of £3,000 a year

In order to prevent an avoidance of IHT through mass gifting, the government put an annual exemption of £3,000 in place. This means you can give up to £3,000 a year, split however you like, to anyone without increasing your tax bill.

While it may not seem like an awful lot compared to how much you could give away, reducing the value of your estate gradually by making the most of your annual exemption can help.

For instance, if you began giving £3,000 a year to your beneficiaries today, and you passed away in 20 years’ time, you’d have reduced the value of your estate by £60,000 overall – which may even bring it under the nil-rate bands.

Plus, there are some additional allowances that you can use ad hoc, including:

- The £250 “small gift allowance” that lets you give financial gifts of up to this amount tax-efficiently

- Gifts for weddings and civil partnerships – you can give up to £5,000 to a child, £2,500 to a grandchild, or £1,000 to anyone else tax-efficiently in celebration of these events.

Utilising these allowances means you can comfortably reduce your estate over time without worrying about a higher IHT bill later on.

If you exceed your annual exemption, the excess could be subject to IHT if you pass away soon afterwards

You may be wondering: “how does giving away money when I’m alive affect IHT?”

If your gifts surpass the annual exemption or the other gifting allowances mentioned above, and you pass away fewer than seven years after the money is transferred, that amount could be subject to IHT.

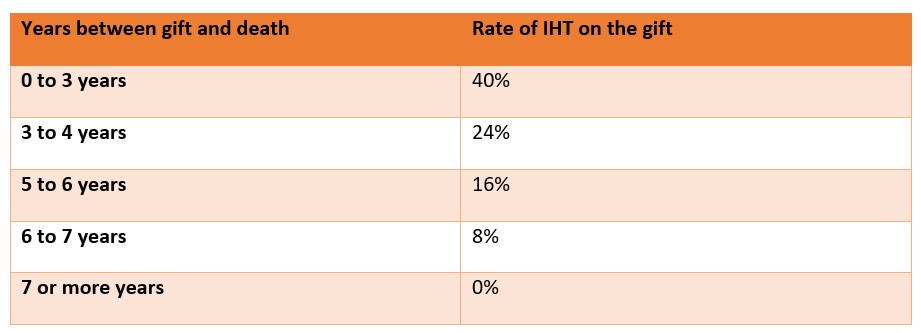

The below table shows the percentage of IHT that could be applied to funds in excess of the annual exemption and gifting allowances.

Source: HMRC

This is known as “taper relief”. The rules surrounding taper relief are complex, but the bottom line is that giving more than the annual exemption could mean the excess still carries an IHT liability.

So, the myth that says you can give your money away before you die to avoid IHT is sadly untrue. There is no way to truly avoid it altogether if your assets surpass the nil-rate bands, but careful estate planning can mitigate an IHT bill.

3. “Placing my wealth in a trust will avoid IHT”

Finally, there are plenty of myths surrounding the act of writing funds into trust – and perhaps most common is the idea that putting wealth in a trust will avoid IHT.

Indeed, it is true that trusts can help reduce the amount of IHT your beneficiaries may pay, but it’s highly unlikely they will pay none at all.

The amount of IHT due on inheritance that is written into trust will depend on:

- The type of trust that is used

- How long the funds have been in the trust

- How soon you pass away after setting up the trust

- How much wealth is in the trust.

Below are two important rules around trusts and IHT to remember.

Assets placed in trust are valued every 10 years, and IHT may be due after each assessment

First, the assets within a trust are usually valued on the 10-year anniversary of the trust being set up, and every 10 years after that.

Upon valuation, an IHT charge of 6% may be applied to the amount above the nil-rate bands.

Wealth in a trust that exceeds the nil-rate bands is usually still subject to IHT

When you pass away, assets in trust that exceed the nil-rate bands are usually subject to a 20% IHT charge, rather than the usual 40% rate.

This can depend on the type of trust, as well as other factors, so it may be helpful to speak with a financial planner when figuring out the amount of IHT your beneficiaries could pay on trust funds. Trusts can be complex, so seeking professional advice is recommended.

Get in touch

To discuss IHT, gifting, and trusts with a qualified expert, email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Production

Production