May 18th, 2023

Your March and April 2023 global market update

As we progress through the spring of 2023, many global equities have begun to see steadily positive returns after experiencing some volatility earlier in the year.

Bank collapses in March, namely Silicon Valley Bank and Signature Bank in the US, and Credit Suisse in Europe, rocked markets temporarily – but in April, many indices made gains as investor confidence returned.

Nevertheless, long-lasting inflation, paired with central banks continuing to raise interest rates in many areas, means cost of living worries have remained.

Read on to find out how global indices performed in March and April 2023.

UK

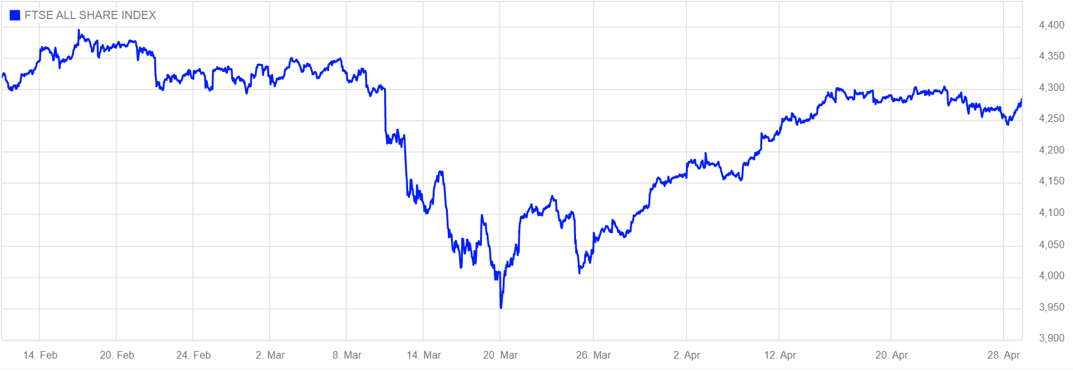

After spiking in February, the UK FTSE All-Share then witnessed a significant downswing in March. This downturn was temporary, however, as the index then recovered throughout April.

Source: London Stock Exchange

As you can see in the above graph, the FTSE All-Share reached a low point on 20 March 2023. This downturn followed the spring Budget, delivered in parliament by chancellor Jeremy Hunt on 15 March, in addition to two US bank collapses in the same week.

Fortunately, though, investors’ fears did not last long. According to JP Morgan, the All-Share closed with a 3.4% return at the end of April.

What’s more, UK inflation slowed from 10.5% to 10.1% between February and March 2023, according to an Office for National Statistics (ONS) report.

While inflation is now moving in the desired direction, the Bank of England (BoE) still holds concerns over its remaining in double figures, and as a result, increased the base rate to 4.25% in March, and again to 4.5% in early May.

So, despite positive market performance, the day-to-day cost of living throughout the UK remains high this spring.

US

In March, the US financial landscape was rocked by two banks entering liquidation in close succession.

The first was Silicon Valley Bank, the country’s 16th largest bank, which faced a $42 billion surge in deposit withdrawal requests in early March. Following three years of buying up government-backed mortgage bonds and US Treasury bonds, the bank’s fixed payments were unable to keep pace with rising interest rates. So, on 10 March, regulators had to intervene and close the bank altogether.

As depositors became spooked by this collapse, Signature Bank saw a swathe of withdrawal requests in the days following, leading to this bank also entering liquidation on 12 March.

Understandably, investors feared a repeat of the 2008 financial crisis, leading many to dispose of assets and causing some volatility throughout March. However, much like in the UK, US equities rose again in April, with the US S&P 500 ending the month with a 1.6% return.

Despite these positive returns in April, on 1 May, another US bank collapsed. First Republic was seized by regulators following a similar pattern to Signature and Silicon Valley Bank: an influx of withdrawal requests that the bank could not keep up with.

So, as the year progresses, it may not be plain sailing for the US banking sector, and for markets overall.

More positively, after falling to 6% in February, US inflation continued to ease, reaching 5% in March, CNBC reports.

Although US inflation is slowing, the Federal Reserve (Fed) has continued to raise interest, implementing its 10th rise in little over a year in early May 2023. This brings US interest to between 5 and 5.25%, according to a CNBC report – its highest rate since August 2007.

Europe

The Eurozone saw many financial positives throughout March and April 2023, despite the collapse of one major bank in mid-March.

Firstly, JP Morgan reports that while inflation has remained high in the region over the course of 2022 and the start of this year, it decreased from 8.5% to 6.9% respectively between March and April.

What’s more, the report claims GDP growth in Europe increased by 0.1% in Q1 2023, potentially reflecting an increase in consumer spending after energy prices fell in the first part of the year.

The closing of Credit Suisse in March, although similar to that of Signature Bank and Silicon Valley Bank in the US, seems not to have rocked markets too significantly.

Indeed, the MSCI Europe (excluding UK) index saw a 2.3% return at the end of April, continuing its trajectory of positive growth and exemplifying current levels of investor confidence.

Asia

Finally, breaking the upward trend of most global indices, the MSCI Asia (excluding Japan) saw -2.1% returns at the end of April.

While the lifting of strict Chinese lockdowns earlier in the year proved positive for the country’s economy at first, with retail sales up by 10.6% year-on-year, JP Morgan reports, geopolitical unrest between China and Taiwan caused Chinese equities to dip by 5% by the end of April.

Outside of China, Schroders reports Indonesian and Indian equity prices showed strong upticks, both driven by increased technological innovation and manufacturing efforts in the countries.

Short-term fluctuations shouldn’t affect your long-term investment goals

Although it can be worrying to read about bank closures and market fluctuations, the bottom line is: your long-term wealth goals remain the same.

Time in the market is often a more effective strategy than timing the market, but if you are looking to sell investments or alter your portfolio soon, checking in with your financial planner could be a constructive next step.

We can ensure your short-term movements align with your long-term financial plan, and answer any questions you might have about what you’ve read in this article.

Get in touch

For a discussion about your long-term financial goals, email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production