July 11th, 2024

Your May and June 2024 global market update

Two months ago, in May 2024, we reported that some stock market indices had reported downturns in March and April. These included the US S&P 500 and the MSCI Europe ex-UK.

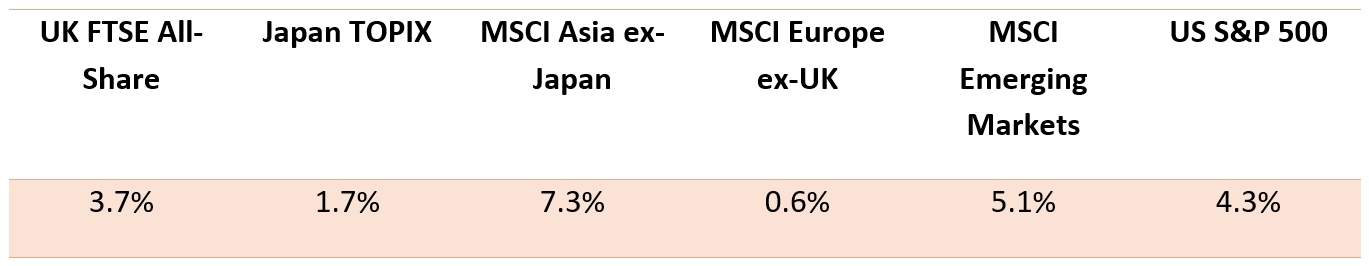

Thankfully, throughout the second quarter of the year (April to June 2024), the tide turned for global markets, returning to the upward trajectory we’ve seen since the end of last year.

Source: JP Morgan

These figures do not reflect any market movements that resulted from the general election on 4 July, which saw The Labour Party win by a landslide. To learn how the election might affect your finances, read further insights on our news page.

Continue reading to learn how markets in the UK, Europe, US, and Asia performed in May and June 2024.

UK

In the year to 30 June 2024, the UK FTSE All-Share saw a 7.4% gain, and between April and June 2024, it reported a 3.7% gain. Schroders also reports that the FTSE 100 index experienced a fresh all-time high in the second quarter of the year.

In part, this boost is due to the rate of inflation inching closer to the Bank of England’s (BoE) target of 2%, finally reaching it in May 2024 and remaining there in June, the Office for National Statistics (ONS) says.

The BoE base interest rate has stood at 5.25% since August 2023 – a 14-year high – but investors and consumers anticipate that the BoE may cut rates in August 2024 in response to falling inflation. This could be another key reason why UK markets have remained strong.

In addition, after a brief recession at the end of 2023, GDP rose by 0.6% in the first quarter of the year, the Guardian reports, further boosting investor confidence.

Only time will tell how markets react to the general election that was held on 4 July – watch this space to find out more in our next global market update.

US

As the US fast approaches its next presidential election, set to be held on 5 November, the S&P 500 index has recovered from the dip it experienced in March and April.

Schroders reports that the information technology and communications sectors led the charge between April and June, stating that “ongoing enthusiasm around artificial intelligence (AI)” was a key driver of gains.

What’s more, US inflation fell to 3.3% in May from 3.4% in April. In response, the Federal Reserve (Fed) is expected to cut its central interest rate in the second half of the year, but as of June 2024 it remains at between 5.25% and 5.5%.

In addition, JP Morgan reports that the US economy added an additional 206,000 jobs in June 2024. Unemployment also rose to 4.1%, its highest rate since 2020.

While this year has been positive overall for US markets, with a contentious presidential election on the horizon for the US, it may be that markets in this region experience volatility in the second half of the year. If you witness any fluctuations in the value of your US holdings in the coming months, it may help to speak to your financial planner before making any decisions about these investments.

Eurozone

The MSCI Europe ex-UK produced a meagre return of 0.6% between April and June, JP Morgan reports.

Unlike in the UK and US, eurozone inflation is proving stubborn, rising from 2.4% in April to 2.6% in May, potentially weakening investor sentiment. This said, the European Central Bank (ECB) cut its three key interest rates from 4.5% to 4.25% in early June, sparking fresh hope for a gradual decline in rates over the rest of the year.

What’s more, Schroders reports that political upheaval across Europe was a core factor affecting markets in the second quarter of the year.

For example, in early July, the BBC revealed that France’s nationalist party, the National Rally (formerly the National Front) had been pushed into third place the behind left-wing party New Popular Front and Emmanuel Macron’s Ensemble Alliance.

But in May and June, the National Rally were predicted to storm the election and enact huge change – this may have disturbed the potential for market growth.

Asia

After returning negative growth in April, the Japan TOPIX bounced back with a return of 1.7% across the second quarter of the year. Plus, the MSCI Asia ex-Japan returned 7.3% in the same period – a positive sign for the region overall.

In Japan, a strong US dollar is contributing to the depreciation of the yen, and the Bank of Japan (BoJ) “expressed concerns about the negative impact of yen weakness on inflation”, Schroders reports.

China, however, may have benefited from this relative weakness in Japan, and JP Morgan says that a rallying real estate sector boosted China’s economy between April and June. Due to ongoing interest in AI, Taiwan was the best-performing market in Asia across the second quarter of 2024, according to Schroders.

Get in touch

We’re here to help you manage your globally diversified portfolio of investments. Email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production