November 29th, 2022

How your hard-earned wealth can help you fight for what you believe in

Everywhere you turn, it seems there is a global issue that needs to be solved. Be it the climate crisis, famine, lack of accessible education, or disease, there is plenty of work to be done to improve our global society.

As an individual with your own struggles, you might feel powerless to stop this tide of global issues – and this feeling of helplessness could even make you apathetic towards them.

One way you could help nurture causes you believe in is through your wealth – and not just by donating to charitable organisations. Investing in funds that are committed to making a positive impact might be just the ticket to changing the world in unimaginable ways.

As you may be aware, here at Prosser Knowles, we are releasing our new sustainable investment proposition in early 2023. This offering will let you pursue a bespoke sustainable investment journey with us, so you can begin to target issues that mean the world to you while growing your wealth.

So, read on to find out how your investments can make an impact, and how we can help make these dreams a reality.

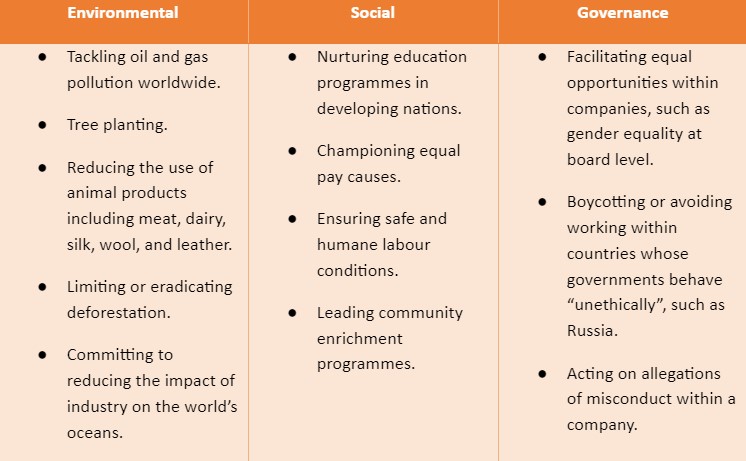

Environmental, social and governance (ESG) investing can help align your wealth with your ethics

Environmental, social and governance (ESG) investing is said to have begun in the 1970s, when some investors began boycotting companies that supported the South African apartheid and the Vietnam War.

The below table lists some of the causes and factors covered by each category of ESG investing.

Sadly, research published by Money Marketing shows many investors (60%) are unaware that ESG investing even exists, never mind its immense benefits.

However, of those who did know about it, 79% agreed they would avoid investing in companies “not taking sufficient action on ESG issues”.

ESG investing can make real-world change possible

You might be thinking: “this sounds great in theory, but could my investments actually make a difference?”

It is understandable that, in a world full of companies accused of “greenwashing” – using “sustainable” language without committing to any real change – you might be cynical about the efficacy of ESG investing.

In fact, there exist many examples of how companies have transformed their practices, angling them towards ESG standards based on shareholder influence. The greater stake investors place on the ESG values of a company, it is likely that the company will become more motivated to make sustainable changes to the way they operate.

For example, Harvard Business Review reports that research conducted in 2019, measuring the performance of 2,000 US companies over 21 years, found companies that invested in “material” ESG measures “significantly outperformed” their competitors.

Indeed, one example offered in the report is that of IKEA. Following a “practical” strategy to ESG transformation, IKEA entered the home solar and “energy storage” business, which grew by 29% in 2019. Plus, they have launched an ongoing initiative that strives to create easily reusable and recyclable products, tackling the issue of waste at the very source of production.

This example makes it clear that, when placed strategically within ESG initiatives, your wealth can make measurable differences that help others.

When you work with us, your financial goals and your sustainable ideals will work as one

So, you’ve decided to angle your investments towards ESG funds. But you could be wondering: “will my finances take a hit when I choose ‘greener’ investments?”

Of course, there is no “yes” or “no” answer to this question. Like any investment, putting your wealth in an ESG fund doesn’t guarantee returns; these funds can be subject to market volatility, just like any other.

However, while past performance is not a reliable indicator of future performance, ESG funds have been increasing in popularity in recent years – and in some cases, have outperformed non-ESG funds significantly.

So, when working with us here at Prosser Knowles, you can have a holistic discussion with your financial planner about investing your money sustainably in order to potentially reach your wealth objectives.

We believe sustainable investing and financial prosperity can go hand in hand. While returns are never guaranteed, together with our expert partners Brooks Macdonald (BM) we are committed to building a portfolio that matches your criteria and helps achieve your goals.

Our investment manager, Brooks Macdonald, can help nurture your portfolio in line with your goals

When tasked with investing your wealth sustainably, we enlist our investment managers to oversee the entire process.

BM have more than 30 years of experience in managing investments, maintaining more than £17 billion in client funds as of January 2022.

Considering your attitude to risk, the time frame within which you wish to invest, your growth targets, and of course your sustainability goals, together with BM we offer a bespoke investment service.

You trust us to create a portfolio that encompasses all your unique criteria, and we maintain that trust by upholding the highest standards of security, risk management, and transparency throughout the investment process.

Get in touch

To hear more about our sustainable investment proposition before its release in January 2023, email enquiries@prosserknowles.co.uk or click here to request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production