December 13th, 2023

Is cash better than investing now that interest rates have risen?

One of the most headline-worthy financial events that has happened in 2023 is that the Bank of England (BoE) continued to hike the base interest rate.

These increases brought the base rate from 0.1% to 5.25% between December 2021 and August 2023.

As you may have read previously, the BoE chose to raise the base rate 14 times in order to curb rising inflation. According to the Office for National Statistics (ONS), UK inflation reached a climactic 11.1% in October 2022 before decreasing again, and as of October 2023, it stands at 4.6%.

Importantly, after the BoE raised interest rates, so too did most mortgage and savings providers. According to Moneyfacts, as of 14 December 2023, the lowest rate available on a five-year fixed-rate mortgage agreement was 4.57%.

While higher interest rates have proved problematic for many mortgage holders, they have also provided a helpful opportunity for savers. After more than a decade of meagre interest returns on cash savings, Moneyfacts now says that savers can open an easy access account at a rate of 5.22%.

Alongside these economic elements, global stock markets have experienced some turmoil since the pandemic began. While volatility is usually short term, many individuals have found that their investment portfolio dipped in value over the past three years.

In light of all these developments, one question we’ve heard many times from our clients in the last 18 months is: “If cash savings accounts are offering interest rates upwards of 5%, and my investments are dipping in value, should I just stick to cash?”

While an entirely understandable question, the confluence of cash and investing is a little more complicated than it seems on the surface.

Keep reading to learn all about the debate between cash and investing in a time of rising interest rates.

Cash might seem less “risky” than investing – but this is not necessarily true

One of the most common reasons savers often prefer cash to investing is that there is little risk of losing capital when your money sits in a savings account.

On the other hand, investing usually carries some risk of losing what you put in.

So, on the surface of things, cash is clearly less risky than putting your hard-earned money in the stock market. It may be true that over the short term, keeping your wealth in a cash account could be a stabler option than investing it – but long term, the opposite could be true in some circumstances.

Indeed, inflation is corrosive to cash over long periods of time, even when the rate of inflation is not as exceedingly high as it has been since the pandemic.

For example, Unbiased reveals that if you had a £10,000 savings pot, and inflation remained fixed at 2.5% a year, your money would be “worth” just £7,812 a decade later.

And, after 25 years, your £10,000 nest egg would have the spending power of just £5,394 due to the rising cost of living.

So, although there is little risk of your cash savings physically decreasing in value, its spending power is likely to depreciate significantly over time.

On the other hand, as you’ll read in the next section, investing some of your wealth could help you to grow your money in keeping with (or exceeding) inflation over the long term.

Historically, equities have often beaten cash in the race against inflation

We know that cash often performs poorly against rising inflation – but what about investments?

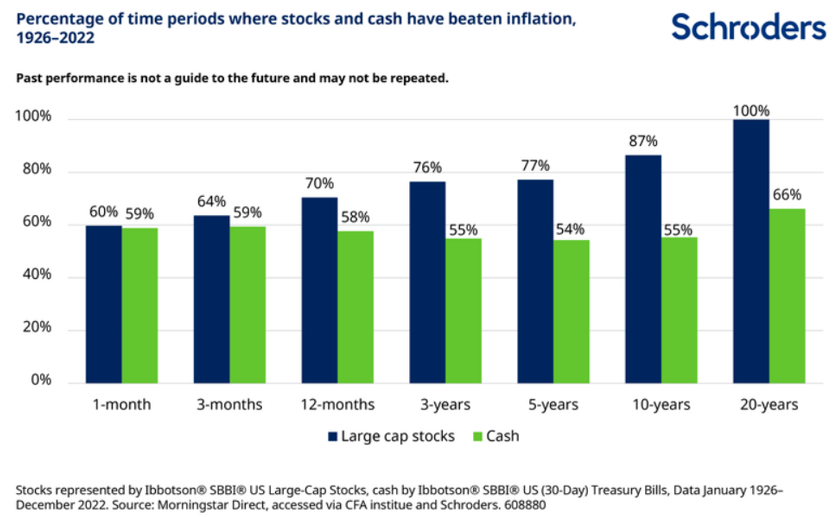

Indeed, although past performance is not a reliable indicator of future performance, a long-term study conducted by Schroders indicates that investing your wealth could be a viable way to outpace inflation.

Source: Schroders

As you can see from this graph, US large cap stocks grew faster than cash when measured against inflation in all time frames measured between 1926 and 2022.

Crucially, the chances of stocks beating cash in the race against inflation increased with time – and as you can see, over a 20-year period, stocks went up faster than inflation 100% of the time. On the other hand, cash only did the same 66% of the time.

This is but one example of how investing could help you achieve your long-term financial goals. Although there is always some risk involved, investing your money over a time frame that suits you could enable you to “inflation-proof” your finances more easily.

There is space for both cash and investments in your financial plan

Although cash can be eaten away by inflation over the years, this does not mean that there is no place for cash savings in a robust financial plan.

On the contrary – there is room for both cash and investments in most financial plans, as each one may play a valuable role in helping you form a solid foundation of wealth you can rely on.

Cash savings are important for:

- Paying for luxuries and one-offs, like holidays, annual insurance premiums, and gifts

- Emergencies, including unexpected household maintenance bills, car repairs, or vet costs for pets

- Unexpected life events – for instance, if you were to lose your job, having two to three months’ salary in the bank could help tide you over.

Meanwhile, balancing your cash accounts with a long-term investment portfolio means you can invest confidently, without needing to cash in your shares if an unexpected event occurs.

Instead, you can leave your investments to potentially grow over decades, and cash them in after this long period to help fund:

- Your retirement

- The next generation of your family with affording their first home, a wedding, or education costs

- Later-life care

- An inheritance.

This is where working with a financial planner can come in useful. We can help you strike an appropriate balance between cash and investments, paying close attention to your lifestyle, attitude to risk, proposed time frame, and any milestone costs you might have coming up.

Get in touch

For more information about how financial planning can help you manage your finances with confidence, email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Production

Production