January 18th, 2023

Selling or buying your home in 2023? Here’s what you need to know

The new year is a time to reassess your dreams and goals and see which ones you could make a reality in the coming 12 months.

Even if you are already a homeowner, you might have plans to hit new milestones when it comes to property – be it taking on a new buy-to-let, helping the next generation onto the ladder, or simply moving to a new home that suits you better.

With the cost of living crisis still affecting many people’s financial circumstances, you may feel concerned about the viability of achieving your property goals this year.

Here’s what you need to know about buying or selling a home in 2023.

House prices have continued to steadily climb in recent years – but the tide has just begun to turn

As you may have observed, UK house prices have continued on an upward trajectory overall for the past decade.

Data published by the Office for National Statistics (ONS) confirms that house prices have been in positive growth year-on-year since 2012.

Most recently, UK house prices rose by 12.6% in the year to October 2022, bringing the average price to £296,000 – a £33,000 increase on the previous year. Compare this to October 2016, when, according to a government report, house prices stood at just £216,674.

Interestingly, numerous reports throughout December 2022 and January 2023 have suggested that house price growth is slowing. While still in a state of inflation year-on-year, a January 2023 report from the Guardian claims house prices have now fallen for four consecutive months.

The report found annual house price growth halved between November and December 2022, from 4.6% to just 2%.

If you are searching for a new home or looking to sell yours, you may already have noticed that prices are stagnating or dropping in your local area.

Indeed, experts are predicting a further fall in month-on-month house prices, driven by a few key market factors.

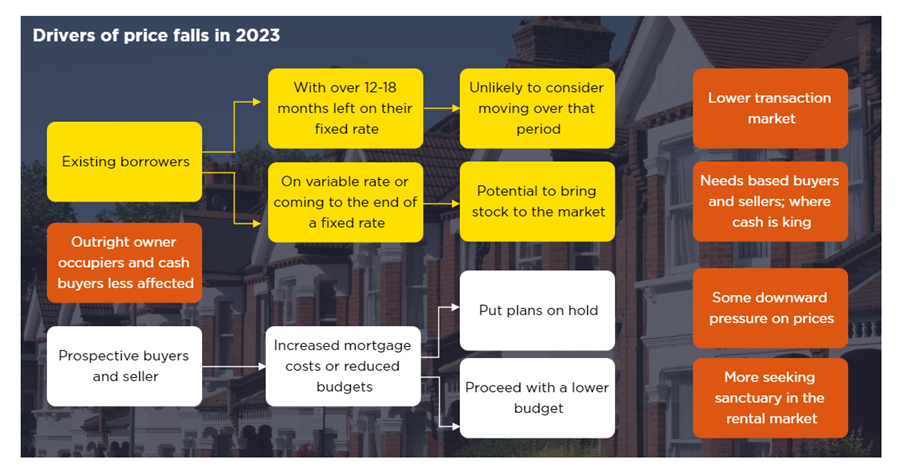

This graphic, produced by industry leaders Savills, shows the likely causes of potential further decreases in house prices throughout 2023.

Source: Savills

As the graphic suggests, a combination of rising interest rates, lower buyers’ budgets, and fewer transactions may see prices fall in 2023.

While it is never certain what might happen in the markets, a drop in house prices month-on-month throughout 2023 could have an impact on your plans.

If you’re selling a home, you may need to prepare for lower house prices in 2023

If house price growth continues to slow, or values begin to fall, you could sell your home for less than you’d originally hoped.

Whether you’re downsizing your buy-to-let business or simply ready to move on from your own home, if prices continue on their current trajectory, you could find your property is valued at a lower price than you’d planned.

Indeed, a survey conducted by the Times found that two-thirds of economists predicted house prices would fall by 4% this year, while Savills predicts nominal prices will drop by 10%.

Budgeting for a lower-priced sale than you’d planned can help you stay realistic, particularly if you are also buying a new home. For guidance on the affordability of selling your home in today’s market, speak to a financial planner today.

If you are a homebuyer, you could benefit from lower house prices in 2023

Conversely, homebuyers could be pleasantly surprised by house prices this year.

While of course, there is no way of knowing how the market will progress throughout 2023, the recent slow in house price growth suggests you could find your dream home for a lower price.

Nevertheless, it is important to stay vigilant when it comes to saving for a home. Although house prices may fall steadily, other contributing factors, explored below, mean homebuyers could face some challenges when looking for a mortgage deal this year.

The Bank of England has raised the base rate nine times since December 2021

During the Covid-19 pandemic, the Bank of England (BoE) dropped the base rate to a historic low of 0.1%. Following this, it was easier for some homebuyers to secure the mortgage deal they wanted, as many lenders followed by example and lowered their rates too.

However, as the effects of the pandemic have eased, the BoE raised the base rate nine times between December 2021 and December 2022. Now, the rate stands at 3.5%.

Plus, following Kwasi Kwarteng’s controversial mini-Budget in September 2022, mortgage rates rose sharply. The Guardian reports more than 40% of the market disappeared “almost overnight” – and while mortgages have somewhat recovered from this shock, rates remain high.

For instance, , the lowest two-year fixed-rate mortgage deal available stands at 4.79%. This higher rate could reflect both the market shocks from September and the BoE’s continuous raising of the base rate.

Importantly, FTAdviser reports that, as of January 2023, mortgage approvals have dropped back to their pre-pandemic levels. If you are searching for a mortgage deal this year, it is crucial to adjust your expectations, especially if you were planning to benefit from the pandemic’s effect on mortgage deals.

So, although house prices could drop this year, it is vital to look at the bigger picture. Assessing whether you can afford a mortgage in the current climate can be a tricky task to perform alone; your financial planner can help review your circumstances.

You may pay less Stamp Duty between 2023 and 2025

In positive news, one of the more popular announcements made in 2022’s mini-Budget was a change to the level at which homebuyers will pay Stamp Duty Land Tax (SDLT) with immediate effect.

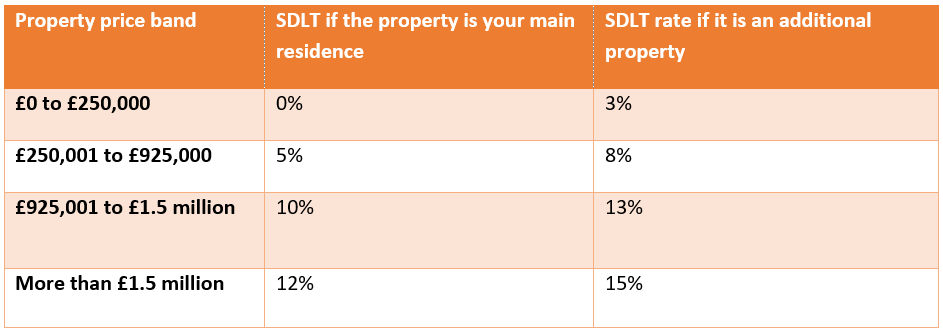

The below table shows the new SDLT rates for homebuyers in England.

Source: HMRC

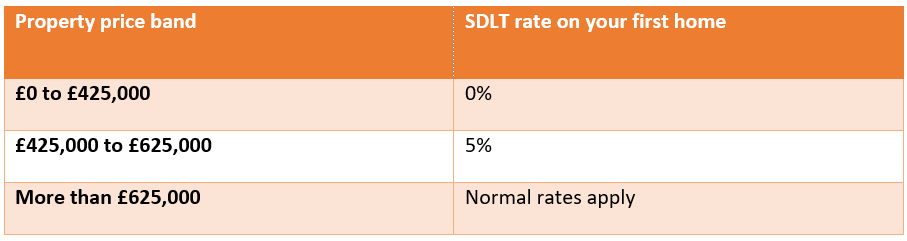

Plus, if you’re helping a first-time buyer onto the ladder this year, they too may benefit from the changes. The below table shows the level of SDLT first-time buyers can expect to pay.

Source: HMRC

Importantly, these rates are only in place until April 2025. So, it could be wise for homebuyers to make the most of their reduced SDLT bill while the rates remain lower in most cases.

Get in touch

When looking to the future and assessing your property goals, changes in the market can be overwhelming.

We can help you:

- Access a wide range of lenders who can discuss competitive mortgage rates

- Work out your tax liability if you’re selling a buy-to-let property, a large property, or a second home

- Manage your expectations when selling your home in 2023

- Calculate an SDLT bill on a property you buy

- Organise protection

- Review your wider financial circumstances before you buy or sell a property.

For guidance on property matters, email enquiries@prosserknowles.co.uk or click here to request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Buy-to-let (pure) and commercial mortgages are not regulated by the FCA. Think carefully before securing other debts against your home.

Production

Production