November 29th, 2022

The pros and cons of offering relevant life cover for business owners

Many of your clients are likely to be business owners who are constantly trying to find ways of being both more financially efficient, and more appealing to talented employees.

Indeed, beyond offering a competitive salary and a positive working environment, your business owner clients could be searching for innovative forms of remuneration, particularly for “core” members of staff on who the success of the business depends.

Retaining talented staff can be expensive, which, during the cost of living crisis, could be worrying to your business owner clients.

With inflation remaining in double figures (11.1%) in October 2022, and the Bank of England (BoE) raising the base rate to 3% in November, your clients’ overheads could already have risen significantly this year.

Luckily, if your clients are determined to offer unbeatable benefits to key members of staff throughout the cost of living crisis and beyond, there is one scheme that could be very attractive: relevant life cover.

Relevant life cover is a “death in service” benefit that involves a company taking out a life insurance policy for a single employee (similar packages for groups can be arranged, too).

If the individual passes away before the cover ends, or is diagnosed with a terminal illness, they may receive a tax-efficient payout similar to other forms of life insurance.

Read on to find out the pros and cons of offering relevant life cover for business owner clients.

The pros of offering relevant life cover for your business owner clients

1. Relevant life cover schemes can be tax-efficient

For employers, offering relevant life cover doesn’t just help retain staff; it can also be extremely tax-efficient if set up correctly.

Tax efficiencies your clients’ businesses could benefit from include:

- Paying no National Insurance contributions (NICs) on the plan

- A reduction in Corporation Tax, as life insurance is usually considered an “allowable expense”.

During a time of increasing overheads, these valuable savings could shave a significant sum off a client’s tax liability.

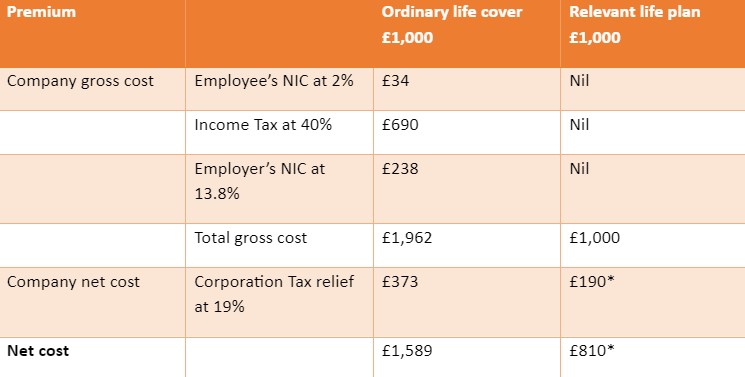

The below table exemplifies how businesses could cut costs on relevant life cover, compared with ordinary life insurance:

*Assumes that Corporation Tax relief is 19% and has been granted under the ‘wholly and exclusively’ rules. In both cases we’ve assumed a payment of £1,000 each year for the life cover on an employee who’s paying income tax at 40% and employee’s National Insurance at 2% on the top end income. We’ve also assumed that the employer is paying Corporation Tax at the small profits rate of 19% and will pay the employer’s National Insurance at 13.8%.

Source: Royal London

Remember: working with a financial planner can help your business owner clients set up their relevant life cover plans tax-efficiently.

Especially as Corporation Tax is set to rise by 6% in April 2023, now could be the time for your clients to consider ways to reduce their tax bill. We can help.

2. The employee will benefit from tax reliefs, too

Along with being financially beneficial for business owners themselves, the employee can also experience financial and emotional benefits with relevant life cover.

Due to the fact that the employee does not “own” the policy themselves, a relevant life cover plan will not usually be subject to Inheritance Tax (IHT), contribute to the pensions Lifetime Allowance (LTA), or the Annual Allowance.

What’s more, employees may pay reduced Income Tax and NICs with a relevant life cover plan, as they will only pay these on their take-home salary.

You can read more about the employee benefits of relevant life cover on our website.

The cons of relevant life cover for your business owner clients

1. Offering relevant life cover will increase company overheads

Of course, taking out a relevant life cover package for an employee will increase your clients’ company overheads on a month-to-month basis.

As the plan is paid for by the employer, and can be taken out in parallel with existing group schemes for individuals of managerial or director status, it can increase the financial burden on a company.

It is important to remember that while outgoings may go up, the tax efficiencies of relevant life cover brings can help dampen this rise over time.

To help determine if relevant life cover is financially viable for your client’s business, get in touch with us today.

2. Relevant life cover plans are less flexible than traditional life insurance options

If your clients are considering offering relevant life cover to an employee, it is important to note that these plans are often less flexible than other forms of life insurance.

One disadvantage could be that these death in service plans usually lapse when the individual turns 75 – unlike whole of life insurance, for instance.

Similarly, once a relevant life cover plan is set up it can rarely be altered, whereas some other forms of life insurance can be adjusted once the cover has started.

It is important for your business owner clients to understand the potential downsides to taking out relevant life cover for an employee before they sign the dotted line.

Get in touch

We’re here to advise you and your clients on all aspects of financial planning. If your business owner clients need guidance, get in touch today. Email enquiries@prosserknowles.co.uk or call 01905 619 100.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Production

Production