March 19th, 2025

The recent surge in probate delays and what it means for your clients’ finances

After a loved one dies, your clients will inevitably experience a significant amount of stress and grief before money even comes into the equation. If they’re the executor of the deceased person’s will, or stand to inherit something from their estate, this stress could increase substantially.

What’s more, there has been a surge in probate cases dragging on for longer than the government’s estimated time frame. While the government still says that probate should be granted within 16 weeks of application, many families’ lived experiences tell a different story.

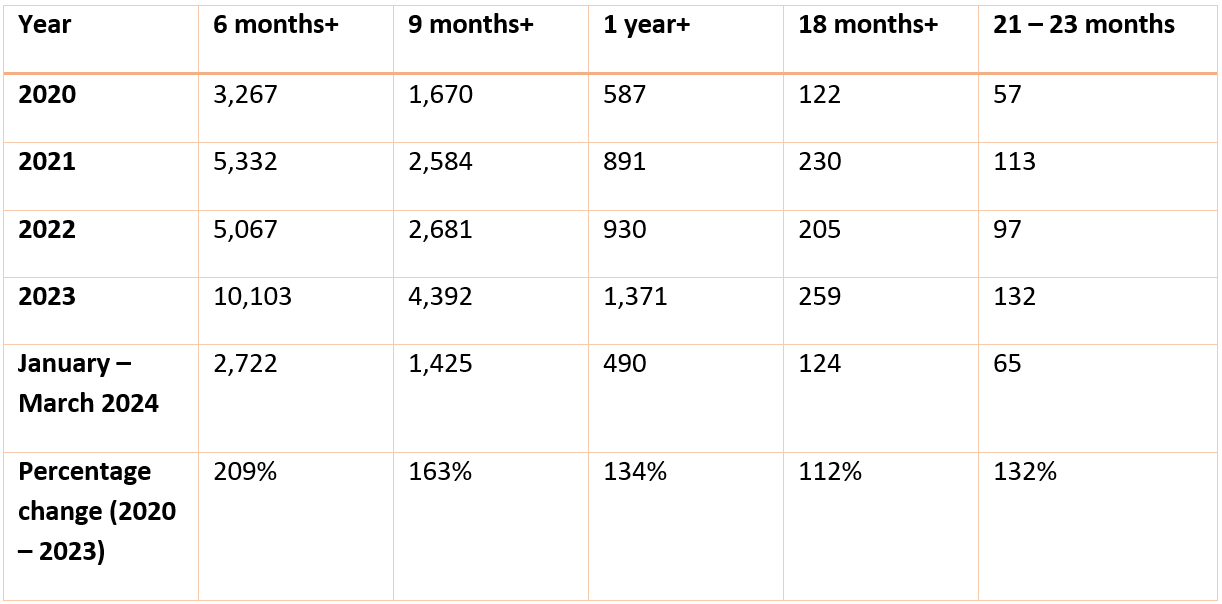

A Freedom of Information request from Quilter revealed that between 2020 and 2023, there was a 134% spike in the number of cases where probate takes more than a year to be granted.

Length of time to grant probate

Source: IFA Magazine

Continue reading to learn why probate delays may be happening, how they could affect your clients’ wealth and wellbeing, and what a financial planner can do to help.

3 key reasons for recent probate delays

There are several factors contributing to the probate delays, including:

1. The aftermath of Covid-19. With so many systems stalling due to lockdown restrictions and a rise in deaths, Covid-19 is bound to have had a lasting impact.

2. System digitisation. More and more governmental processes have gone online – and while beneficial in the long run, these systems are still in their infancy and many applicants experience errors and issues.

3. Changes to Inheritance Tax (IHT) and pensions. This doesn’t explain the 2020 – 2023 rise, but now that pensions are likely to be included in the IHT net from 2027, further probate delays could be on the cards.

4 ways your clients’ wealth and mental health may be affected

Both financially and emotionally, probate delays may take their toll on your clients.

1. A delayed windfall

If your client knows how much they’re set to inherit from the estate, they could be holding off on making important plans while they wait.

For instance, they could be planning to use this money to help their child onto the property ladder. But if they’re unsure how long it will be before the funds arrive, the impact will not only be on the beneficiary, but on the child they want to help out financially.

What’s more, if your client hasn’t realised just how long probate may take, they could already have taken out loans to pay for certain things, knowing they’ll be able to pay it back once the money comes in. But this is a potentially risky move, especially in light of these delays.

2. Paying IHT out of pocket

As you may know, any IHT due on an estate should (at the time of writing) be paid within six months of the person’s death. If the estate doesn’t pay their bill, HMRC begins to charge interest at around 7%.

Without access to funds from the estate in the event of a probate delay, the executor may be forced to pay IHT out of pocket in order to avoid accruing interest.

While it is sometimes possible to release funds specifically for this purpose, this is not always the case.

3. Legal fees

While some probate solicitors charge a fixed fee, others operate on an hourly rate. If this is the case for your client, and they aren’t granted probate for more than a year, they may rack up legal fees simply by communicating with their solicitor about the delay.

4. Prolonged stress

All of the above can really take its toll on grieving clients who already have enough on their plate.

Your clients might experience a lack of sleep, difficulty concentrating, and even depression or anxiety, due to the long-term financial and mental impact of probate delays.

Financial planning can help bereaved individuals to gain peace of mind

While we can’t make the probate process go any faster, our financial planners could give your clients peace of mind – especially if they are bereaved and unsure of their future position.

We’ll use cashflow modelling software to map out your clients’ future circumstances, taking an eventual inheritance into account. In the here and now, we can provide guidance and reassurance on managing their finances and paying any fees due.

Get in touch

To find out more about what we do and how we might be able to help your clients, get in touch today.

Email enquiries@prosserknowles.co.uk or call 01905 619 100.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, cashflow planning, or tax planning.

Production

Production