April 12th, 2022

The simple yet powerful benefits of maximising your ISA savings at the start of the tax year

The tax year began on 6 April, and with it came renewed savings opportunities.

As the tax year begins, now is a great time to review your investments, and whether you are doing all you can to maximise returns for the year ahead.

One simple, efficient, and highly popular way to save is through an Individual Savings Account (ISA).

Indeed, data published by Which? shows that there were more than 2.7 million Stocks and Shares ISA subscribers in the 2019/20 tax year. In the same year, the number of Lifetime ISA (LISA) subscribers more than doubled.

Read on to find out about the different types of ISAs available, and how strategically timing your ISA contributions could help you grow your wealth efficiently.

You can save a tax-free sum into your ISAs every year

Across all the ISAs you hold, you can save a maximum of £20,000 in the 2022/23 tax year. Any profits you yield from your ISA savings are subject to neither Income Tax nor Capital Gains Tax (CGT).

There are individual contribution limits applied to each type of ISA account, such as:

- Cash ISAs and Stocks and Shares ISAs

Cash and Stocks and Shares ISAs can receive a maximum of £20,000 in the 2022/23 tax year. This £20,000 limit is spread across all the ISAs you hold.

A Stocks and Shares ISA provider invests your money, meaning there is greater potential for high returns, but you risk losing capital too. Cash ISAs pay interest, and are considered lower-risk than Stocks and Shares ISAs.

- Lifetime ISA (LISA)

A LISA is an ISA that can only be used for buying your first home or retirement. LISAs can receive up to £4,000 in contributions a year. So, you could maximise your contributions to a LISA and still invest up to £16,000 into a Cash or Stocks and Shares ISA (or a combination).

All LISA contributions receive a 25% top-up by the government, so your LISA could be boosted by a £1,000 government top-up in 2022/23. You have to be aged between 18 and 40 to open a LISA.

- Junior ISA (JISA)

You can save up to £9,000 into a JISA in the 2022/23 tax year, which is an ISA designed for under-18s. You can open a JISA on behalf of your child, to begin saving for their future as early as possible.

Contributing into your Stocks and Shares ISAs at the start of the tax year has been shown to yield positive results in the past

Contributing as much as you can, as early as you can, gives your savings longer to grow in a tax-efficient environment.

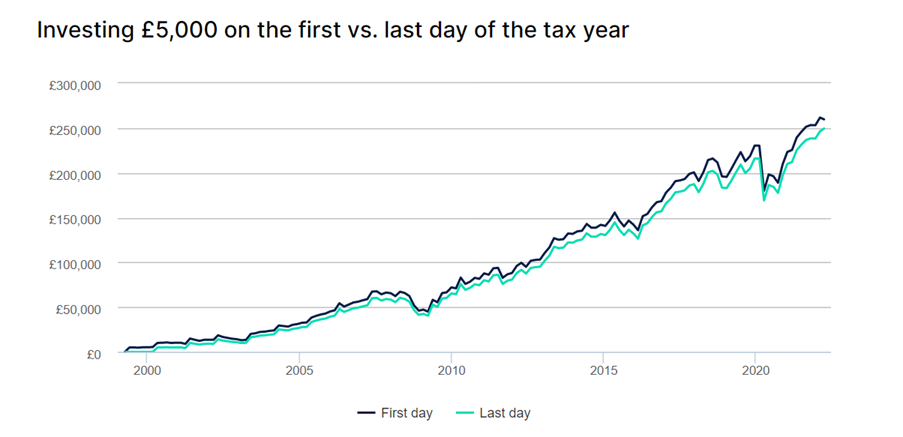

Indeed, research conducted by a leading investment app compared the difference between investing £5,000 into a Stocks and Shares ISA at the start of each tax year, versus doing the same at the end of the year.

Both scenarios yielded overwhelmingly positive results – both accounts saw more than 115% growth from April 1999 to the end of the 2021/22 tax year, not including charges. However, you would have profited £10,000 more by investing at the start of the tax year.

Source: HL

Remember, the value of your investment can go down as well as up, and past performance is not a reliable indicator of future performance.

You could regularly contribute into your Stocks and Shares ISA throughout the year, rather than paying in all at once

You may not feel confident about investing a large sum into your Stocks and Shares ISA at the start of the tax year. Indeed, market volatility in the first quarter of 2022 has made some investors cautious.

So, instead of contributing a single lump sum, you could make regular ISA contributions across the tax year.

Investing on a monthly basis spreads out the cost of your investment, potentially alleviating some risk if markets fall in value in the short term. This is called “pound cost averaging” and it can help to smooth returns in a volatile market.

Here’s an example.

Investing a lump sum at the start of the tax year

- You have £8,000 to invest in April and the unit price is £1. Investing your entire lump sum means you buy 8,000 units.

- In May, the unit price falls to £0.80. As you have 8,000 units, your investment is now worth £6,400.

- In June, the unit price rises to £1.50. As you have 8,000 units, your investment is now worth £12,000.

Investing regularly throughout the tax year

- You have £8,000 to invest in April and you decide to invest £4,000 now and £4,000 in May. You buy 4,000 units now at a unit price of £1.

- In May, the unit price falls to £0.80. Your additional £4,000 investment buys you a further 5,000 units.

- In June, the unit price rises to £1.50. As you now have 9,000 units, your total investment is then worth £13,500.

Investing regularly means that your ISA contribution could increase the value of your investment, even when you buy the same number of units.

On the other hand, if markets are rising steadily, it may be better to invest a lump sum, as you may be able to buy fewer units in the months ahead, if the value continues to rise.

Get in touch

The start of the tax year is the ideal time to get in touch with your financial planner. By talking through your goals with a trusted professional, you could feel more confident about managing your finances in the year ahead.

We can help you assess your savings targets for the coming months, so you can more easily meet your financial goals and live the life you deserve.

Email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Furthermore, this article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production