March 19th, 2024

Your January and February global market update

In our stock market update for the final two months of 2023, we reported that global indices had experienced upswings across the board.

After the intense dips that occurred between 2020 and 2023, there was finally some good news for investors who may have breathed a sigh of relief at the end of last year.

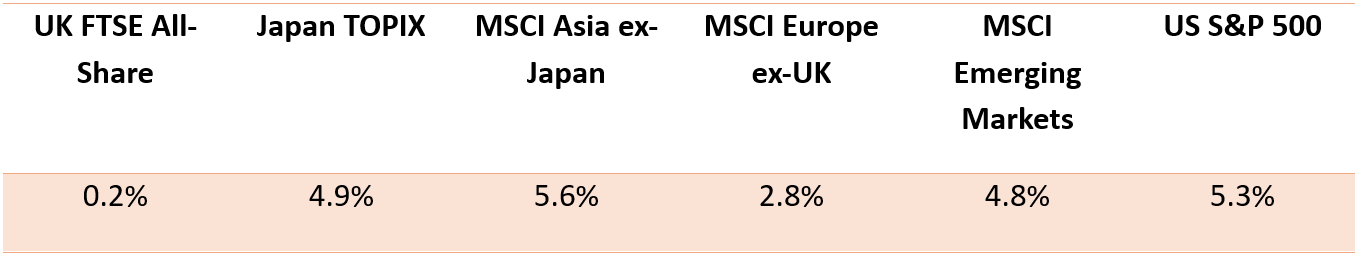

As you can see from the below table, by the end of February 2024, several global indices reported gains once again – although compared with the upticks seen in December, some indices experienced a slowdown in growth.

Source: JP Morgan. Figures relevant for time frame between 1 February 2024 and 29 February 2024.

As the first quarter of 2024 draws to a close, find out all you need to know about how markets performed in January and February of this year, plus what these movements could mean for your investment portfolio.

UK

UK equities fell in January 2024 but rebounded again in February, with the FTSE All-Share index seeing a 0.2% increase by the end of the month.

In part, the somewhat stagnant performance of UK equities may have come down to stubborn inflation. However, inflation fell by more than expected in the year to February 2024 – to 3.4% the Office for National Statistics (ONS) reports – fuelling expectations that the Bank of England may start to cut interest rates in the summer.

What’s more, official data published by the BBC found that the UK entered a recession in the final three months of 2023, potentially dampening investors’ enthusiasm at the start of the year. This said, the UK is not predicted to be in a recession for long, potentially having a positive effect on market performance going forward.

Nevertheless, UK holdings stood firm against this news, as evidenced by the FTSE All-Share’s gain of 0.2%.

While growth may not have been hugely impressive in January and February, the anticipation of chancellor Jeremy Hunt’s tax-cutting Spring Budget may have brought hopes for a more stable future in the coming months. You can read our full insights about the winners and losers of the 2024 Spring Budget, and a full summary of the chancellor’s announcements, on our news page.

US

With investors hoping that the Federal Reserve (Fed) would cut interest rates at the end of January, and strong gains from large cap tech stocks, US markets performed very well in January.

At the end of the month, the Fed surprised investors and consumers by holding firm on interest rates, maintaining the central rate at between 5% and 5.25%. Schroders reports that a March rate cut is “unlikely”, which could affect US market performance going forward.

For now, however, US holdings are proving resilient, with the S&P 500 seeing a 5.3% gain in the month of February.

One important contributing factor to US markets is the upcoming presidential elections. While it is yet unclear which way the pendulum will swing, it could be wise to keep in mind that US markets may prove volatile in the coming months. As such, consulting your financial planner before making changes to your US holdings could be helpful, especially in a time of political change.

Europe

Similarly to interest rate hopes that bolstered US investors at the start of the year, European equities rose in January under the assumption that the European Central Bank (ECB) may cut interest rates. However, seeing as inflation in this region rose from 2.4% to 2.9% in December, the ECB did not slash rates as hoped.

In more positive news, CNBC reports that inflation eased from 2.8% to 2.6% in February, and the European technology sector did extremely well, helping to boost the MSCI Europe ex-UK index to its 2.8% gain. It is important to note that the ECB has been firm in its position of higher-for-longer interest rates, so it may be wise to assume that no drastic rate cuts may be made in the near future.

Of course, the ongoing war in Ukraine means that several sectors in Europe may remain volatile in the coming months.

Asia

The Japan TOPIX index rose by 4.9% between 1 and 29 February, and the MSCI Asia ex-Japan finished the month with a 5.6% gain.

Japan’s technology sector has seen a considerable amount of interest from global investors, leading the TOPIX to end 2023 with a 28.3% gain at the end of 2023 – so its continued upward trajectory may be welcome news to those invested in Japanese holdings.

Outside of Japan, China’s poor economic outlook is beginning to see better days after lunar new year spending boosted economic activity, Reuters reports. In turn, Schroders reports that China was one of the strongest mainland Asian markets in February, alongside South Korea and Taiwan.

Work with a financial planner to create an investment portfolio designed with your goals in mind

If you are looking to establish, expand, or diversify your investment portfolio, working with us could offer significant advantages.

Our experts are here to help you assess your appetite for risk and desired time frame, so you can invest your wealth with your unique goals in mind. To learn more, email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production