November 17th, 2023

Your September and October 2023 global market update

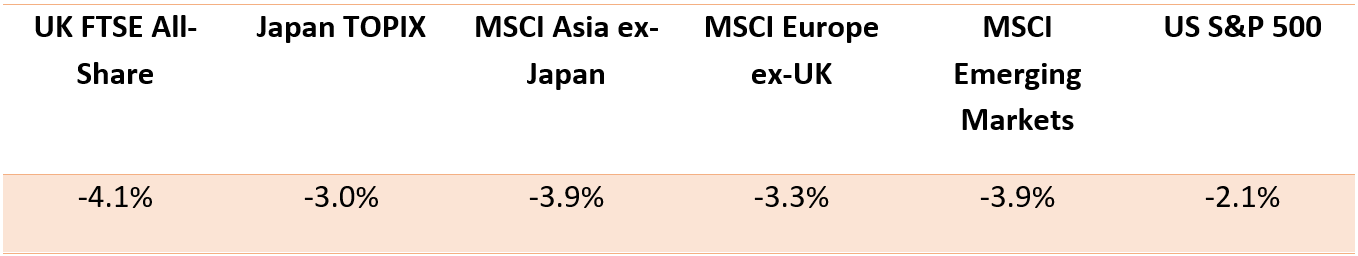

While this year’s performance has been positive in many areas for global markets, by the end of October 2023 global indices were reporting downswings across the board.

As you can see from the below table, each of these indices ended October on negative growth.

Source: JP Morgan

As stated by one of our discretionary fund managers (DFM), Brooks Macdonald, “Global equities fell in October as central banks appeared to reinforce a higher-for-longer interest rate outlook. A rise in geopolitical risk, with conflict in the Middle East, added to the gloom.”

Although this may seem like a purely negative outlook, there are some positives to consider too – and there’s some suggestion that markets could begin to rally before the end of 2023.

Keep reading to find out how UK, US, European, and Asian markets fared in September and October, and how we can help manage your investments in times of volatility.

UK

According to JP Morgan, UK retail sales dropped by 0.9% month-on-month in September 2023. This may be due to the Bank of England (BoE) keeping the base rate at 5.25% between August and September (and now continuing into November).

Indeed, after experiencing 14 consecutive base rate rises between December 2021 and August 2023, it seems investors and consumers had hoped the base rate would now drop – but instead it has remained at 5.25%. As winter approaches, bringing Christmas costs and increased energy bills into the mix, it may be that UK investors are becoming increasingly cautious as the year draws to an end.

What’s more, the frozen base rate was coupled with “sticky inflation” in this time period. Inflation stood at 6.7% as of September 2023, the Office for National Statistics (ONS) reports, but dropped significantly in October to 4.6%, as the ONS announced in November.

All this has contributed to a -4.1% drop in the UK FTSE All-Share index, although in the year to October 2023, this index has posted 0.3% growth. While meagre, these overall returns signal slight improvement compared to the volatility experienced in 2022, which led to the index posting only 0.3% growth for the whole year.

Plus, the fall in inflation announced in November could help to rally markets before the end of the years, as it signals that the cost of living could be returning to a relatively sustainable state.

This said, as the chancellor’s Autumn Statement approaches, falling on 22 November 2023, it’s unclear how the rest of the year may look for UK markets. We’ll be publishing a full breakdown of Jeremy Hunt’s Statement soon after it’s delivered, so stay tuned for an update.

US

Much like in the UK, the US is beginning to feel the pinch of “higher for longer” interest rates. The US S&P 500 index fell by -2.1% in October, although its year-to-date growth stands at an impressive 10.7%.

While US inflation remains stubborn at 3.7%, the Federal Reserve (Fed) has maintained interest rates at a higher rate in much the same way as the BoE, which may be reducing spending and knocking consumer confidence.

Despite stock market dips, the US economy remains resilient, with GDP growing by 4.9% in the third quarter of 2023, JP Morgan reports.

Although the US economy seems to be thriving now, the “higher for longer” interest and inflation conditions could begin to bite as the year draws to a close.

Europe

The ongoing Russian invasion of Ukraine (among other factors) destabilised markets in 2022, and has continued to cause volatility and slow European economic growth this year. In the year to October 2023, European GDP rose by just 0.15%, Brooks Macdonald state.

In more positive news, the report claims that inflation in the region is predicted to have dropped from 4.3% to 2.9% between September and October, which may help to boost disposable income going forward.

Plus, although the MSCI Europe ex-UK index posted negative growth of -3.3% at the end of October, the index has risen by 6.3% year-on-year, signalling that stabler times could be easing in.

Nevertheless, fears of a European recession are still present. As we reported last time, Reuters says that Germany entered a recession in the first quarter of the year – and with GDP growth just scraping into positive figures, uncertainty around Europe’s economy prevails.

Asia

The MSCI Asia ex-Japan stock market index also posted negative growth of -3.9% at the end of October, as concerns over the Chinese real estate sector and prevailing tensions with Taiwan remain.

What’s more, the US has banned the export of certain artificial intelligence (AI) chips to China, CNBC reports, slowing the boom in AI semiconductor sales and potentially hurting earnings in this sector going forward.

And, after a bumper year for Japanese stocks, the Japan TOPIX also dipped by -3%. However, in the year to October 2023, the index has still performed amazingly, with a 21.9% year-to-date return; the MSCI Asia ex-Japan, on the other hand, has performed negatively over the year, witnessing a downturn of -4%.

No matter the market conditions, your investment portfolio is in expert hands

Although you may be worried about ongoing geopolitical tensions, along with domestic worries of inflation and interest rates remaining at their current levels for a while, remember that a well-diversified investment portfolio is designed to withstand market shocks.

When you work with investment experts who have weathered all sorts of market storms, you can rest assured that we’re doing all we can to place your portfolio in a favourable position. There is no saying what could happen in the future, but we can offer you the peace of mind that we’ll always be here to support your investment goals.

Get in touch

If you’d like to learn more about how we manage our clients’ investments, or discuss anything you’ve read here, email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production