November 18th, 2024

Your September and October 2024 global market update

Last time, we reported that market indices in the UK, US, Europe, and Asia had posted growth across the board, with the exception of the Japan TOPIX.

However, now that September and October have passed, we know that markets did not perform as favourably during these months.

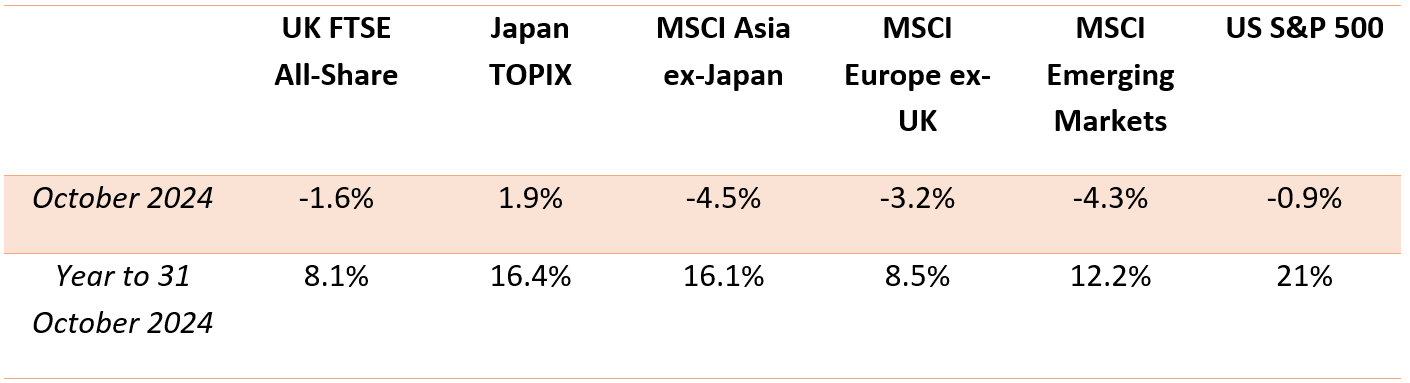

The below table shows the performance of six world indices during the month of October 2024, and in the year to 31 October.

Source: JP Morgan. Data reflects market movements between 1 and 31 October 2024 and year to date 31 October 2024.

As you can see above, despite downturns in recent months, the overall market performance has been extremely positive in the last year.

Keep reading to discover the key events behind the recent downturns and how your financial planner can help you manage your portfolio.

UK

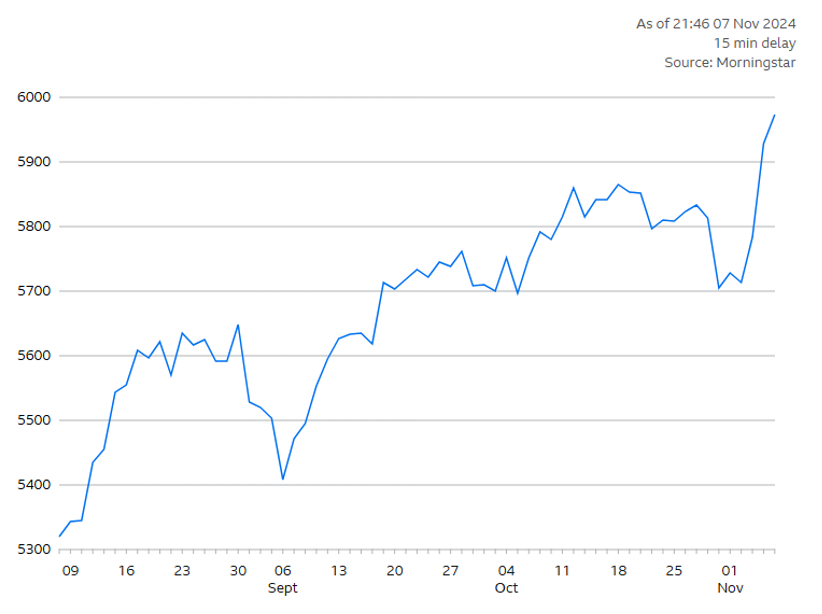

The below graph shows the performance of the FTSE All-Share between 8 August and 8 November 2024.

Source: London Stock Exchange

As September and October unfolded, UK consumers and investors were hotly anticipating The Labour Party’s first Budget since 2010. It was delivered on 30 October, and you can read a full summary of the announcements on our news page.

In the lead up to this event, chancellor Rachel Reeves warned of “difficult decisions”, citing a “£22 billion black hole” left in the public finances by the Conservatives. As predicted, the chancellor raised Capital Gains Tax (CGT) rates to match pre-existing property rates, making the sale of business and non-ISA shares more expensive for investors (among other tax measures).

Meanwhile, our discretionary fund manager (DFM), Brooks MacDonald, reports that in September, British public sector debt rose to 100% of GDP for the first time since the early 1960s.

More positively, the Office for National Statistics (ONS) reports that UK inflation fell to 1.7% in the year to September 2024, down from 2.2% in August. The BoE kept the base rate at 5% in September and October, choosing to reduce it to 4.75% on 7 November. The ONS then reported that inflation rose again to 2.3% in the year to October 2024, so inflation decreases may be halted until inflation returns to the BoE’s target of 2%.

US

The question on everyone’s lips in the past few months has been: “Who will win the US election on 5 November?”

The hotly contested race between Kamala Harris and Donald Trump finally ended in early November, with Trump returning to the White House as the 47th president of the United States.

The below graph shows the performance of the S&P 500 between 9 August and 8 November 2024.

Source: BBC

With the race polling closely throughout September and October, nobody could predict the outcome of the election – and investors are often pessimistic when presented with uncertainty. Fortunately, as you can see above, Trump’s success sent US markets soaring.

Elsewhere, the Federal Reserve (Fed) maintained its central interest rate at 5% throughout October before cutting it by around 0.25% at the start of November, CNBC reports.

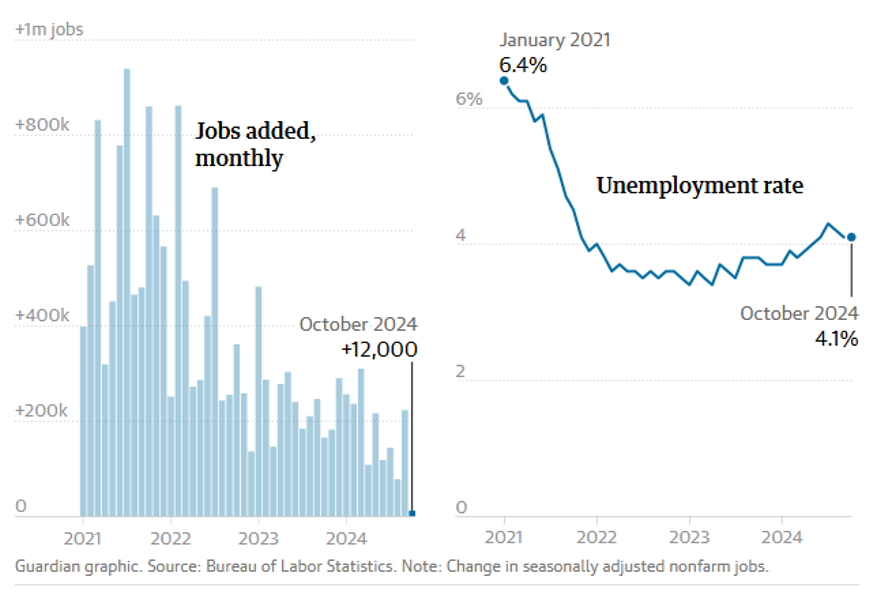

Employment maintained a continued downward trend, as you can see from the below graphs.

Source: the Guardian.

If you hold US stocks, it’s crucial to remain calm and avoid acting rashly as a result of the US election or any other announcement from the country.

Eurozone

Declines in industrial and car production across Europe, particularly in Germany, weakened the economic backdrop in Europe, according to JP Morgan. This, among other factors, resulted in market declines of 3.2% within the MSCI Europe ex-UK index.

Plus, several European countries are involved in diplomatic talks in relation to the conflict in the Middle East, potentially spooking consumers and investors who are concerned about what may unfold in future.

In more hopeful news, eurostat reports that eurozone inflation fell to 1.7% in September 2024, the same rate as the UK, sparking fresh hopes of further interest rate cuts from the European Central Bank (ECB).

Asia

Both the Japan TOPIX and the MSCI Asia ex-Japan indices have posted year-to-date gains above 16%.

After a rough summer for Japanese markets, the Japan TOPIX rebounded with a gain of 1.6% in October, thanks to the falling yen promoting investment in large cap tech stocks, Schroders reports.

Outside Japan, Indian share prices fell steeply in October after the conflict in the Middle East caused worry about the supply of oil, one of India’s largest imports. What’s more, the Chinese property sector experienced a continued decline and, together with other mitigating factors, caused a market dip in this region.

We can help you ride out market volatility and build a diverse portfolio

Here at Prosser Knowles, our specialist financial planners can help you remain calm, stay invested, and build a portfolio geared towards your specific goals.

Email enquiries@prosserknowles.co.uk or request a callback from one of our advisers.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production